We Finance Farmers

Who Feed the World.

Our Business

Our Business

Agrolend Credit

Agrolend finances small and medium-sized farmers, in partnership with resellers, cooperatives and agricultural input and equipment industries, quickly, easily and without bureaucracy.

Fund-raising

Agrolend raises funds from investors through the issuance of LCAs (Agribusiness Letters of Credit) which are acquired by small and medium-sized investors on digital investment platforms. Agrolend LCAs have income tax benefits and are guaranteed by the FGC up to defined limits.

Successful Partnerships

Agrolend always finances rural producers in partnership with input resellers, cooperatives, agricultural equipment resellers, and agribusiness industries.

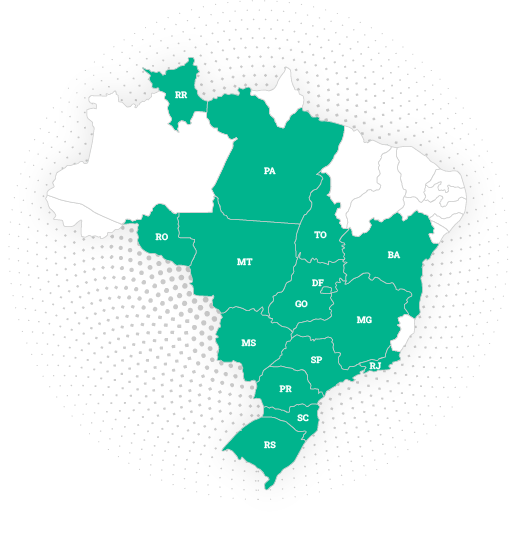

When the rural producer buys his inputs or equipment, Agrolend provides the financing and transfers the funds to our partner, who delivers the products to the rural producer. We have partners spread throughout Brazil, in more than 15 states.

Successful Partnerships

Our Strategy

Agrolend is a leader and innovator in its segment. We do this through our approach that combines:

Agribusiness

Brazil is a global leader in many industry chains, representing onethird of the country's GDP.

Clients

Small and medium-sized farmers involved in numerous agricultural crops and livestock.

Distribution

Origination though our partnership with industries, retailers and investment platforms.

Conservatism

Rigorous credit granting, diversified loan portfolio, and nationwide presence.

Our Investors

We have a diverse group of investors who support Agrolend so that we can grow and serve our customers at the scale they need. Our investors have the ability to invest billions of reais in long-term capital.

We are regulated by the Central Bank of Brazil.

You can count on the security of our institution.